A call to action: building an index insurance community in Bangladesh

“But why do you want to buy index insurance?” asked the International Food Policy Research Institute (IFPRI) index insurance pilot representative in the Bogra region of Bangladesh. “You already irrigate if there’s a dry spell – you are already protected against drought.” The farmer replied “the answer is simple. We can use the insurance to pay for the irrigation in a drought year which will allow us to better manage our farms”

Increasing agricultural productivity is a big issue in Bangladesh. The country has both one of the highest vulnerabilities to climate change and one of the highest population densities in the world. And while more and more food is needed to feed the growing population, the already densely inhabited land is shrinking across the country by around 1% a year, due to a combination of erosion, subsidence and sea level rise.

To deal with the situation, farmers are being forced to change their farming practices by for example intensifying production or diversifying into high value crops.

But in a country where land productivity is threatened by salinity, water logging, floods, droughts and seasonal changes, investing in your farm always means taking a risk.

AGRICULTURAL LANDS AND PRODUCTIVITY IN BANGLADESH ARE THREATENED BY EROSION, SEA LEVEL RISE AND HIGH VULNERABILITY TO NATURAL DISASTERS. PHOTO: Bill & Melinda Gates Foundation

If a farmer cannot repay a loan for inputs in one year out of five, they might forego hundreds of dollars of potential profits in other years, even if the drought or flood never occurs. This situation is likely to get worse considering the increasing uncertainty and unpredictability brought about by climate change. In a good year, the results from these investments could transform farmers’ livelihoods.

But a ‘bad year’ due to droughts or floods can be catastrophic, leaving the farmer with nothing with which to repay their loans. The result of this is that even the threat that ‘next year might be the bad one’ prevents farmers from investing in that productive chance.

Enabling higher productivity

Index insurance is a financial tool which helps to protect farmers against this climate risk and allows them to take those productive chances. The concept is simple – rather than a farmer being insured directly against loss in their farm, insurance is linked to an ‘index’ such as rainfall amount or river levels, so it would pay-out if there was a drought or flood.

Learn more: If understood properly, crop insurance a viable solution for farmers

When compared against traditional, loss based insurance, the cheaper prices, reduced moral hazards and simplified logistics, as fewer farm visits are needed, of index insurance means that projects are often able to protect populations believed to be unreachable due to poverty or technical issues.

In addition, when insurance completes a package that reduces the risk of a farmer not being able to repay a loan for inputs enough that it is safe for them to invest in their farms, then the profits they make can often easily cover the insurance premiums.

Learn more about the above in the book: The challenges of index-based insurance for food security in developing countries

The aim of index insurance is not to remove all risk from a farmer’s life. Instead if it can reduce the risk of a bad year just enough for farmers to take a chance and become more productive then it has a place in the risk management portfolio.

The centrepiece of many successful index insurance schemes is that they identify a productive activity that cannot be undertaken because of climate risk and build a risk management strategy complemented by a little bit of insurance that allows the farmer to take the chance.

Many poor farmers have now bought index insurance products and the concept has been highlighted by Kofi Annan and directly mentioned in President Obama’s new Global Climate Plan.

However, there are still plenty of obstacles and issues for index-based insurance products and farmers in many countries still hesitate to purchase these types of services.

Learn more about what impacts farmers' decisions to adopt insurance products: How to accommodate farmers wary of rainfall insurance

From theory to practice

In addition, at 10 years old, index insurance is still younger than the iPad and Facebook and there are still many challenges to overcome. These include technical challenges on aspects such as basis risks, i.e. where there is loss but the insurance contract does not trigger, and the best use of weather measurements

But equally as importantly, we are still working out how index insurance fits within the full spectrum of climate risk management – it is not effective in isolation and must be regarded as the last piece of the risk management system.

Making a farmer-driven, solid science based, holistic risk management system is difficult and all parties, including scientists, insurers, farmer groups and policy makers must have a sophisticated understanding of the process and its local context.

The CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS) research theme on Climate Risk Management is working to build cross-center collaboration with researchers throughout the CGIAR involved in index insurance, towards its application as part of comprehensive climate risk management strategies in development policy and practice.

As part of this effort, CCAFS engaged in a recent workshop to build connections with CGIAR centers and practitioners working on index insurance in Bangladesh. Bangladesh has a number of index insurance projects underway, providing an opportunity to share and synthesize knowledge and experience from the field.

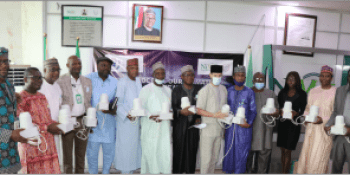

Mapping index insurance stakeholders at a recent workshop in bangladesh. Photo: M. Braun (Worldfish)

Mapping index insurance stakeholders at a recent workshop in bangladesh. Photo: M. Braun (Worldfish)

Now, the wave of interest around index insurance has spread to Bangladesh.

There are now 5 pilot schemes exploring how the concept might work in the country, ranging from farmer driven research (including schemes linked to International Food Policy Research Institute (IFPRI), the International Maize and Wheat Improvement Center (CIMMYT) and the International Rice Research Institute (IRRI) to operational flood insurance (Oxfam), to schemes which build the capacity of governmental and industry partners - Asian Development Bank and International Finance Corporation.

Many index insurance pilots however stay pilots and it is often difficult for existing schemes to find out about or learn from each other’s successes and mistakes.

Learn more about our work on climate insurance activities in India: Farmers reap the benefits from climate insurance scheme

Moving beyond pilot projects

In September 2013, WorldFish and the International Centre for Climate Change And Development (ICCCAD) organised a two-day workshop in Dhaka to share experiences and open a dialogue on index-based insurance. They invited all stakeholders with experience in index insurance in Bangladesh – including scientists, donors, NGOs, policy makers, insurance companies, microfinance organisations and the private sector.

A recent workshop led to the creation of a community of practice for index based insurance in bangladesh. Photo: M. Braun (Worldfish)

Importantly, the workshop was action orientated – the aim wasn’t simply to talk about the problem, rather to give the opportunity to participants to share their experience, successes and challenges, and discuss what actions and best practices need to be undertaken to move forward. See the scoping report for more information.

Activities included a summary of current schemes, stakeholder mapping, plus discussions on issues such as:

- How to involve farmers in the design process? How to overcome a lack of scientific data?

- How to design a relevant index and how to define the basis risk?

- Can, or, should sustainable index-based insurances be subsidized?

- How to scale up from pilots to large scale operational projects

- How to best use and adapt ‘global’ index insurance lessons to Bangladesh?

- How to move index pilots from a purely index insurance scheme to a more holistic risk management initiative?

Building a community of practice

The workshop led to the creation of a Community of Interest and Practice for Index based Insurance in Bangladesh, as a platform to stimulate dialogue, knowledge sharing and collaboration between stakeholders and it is the first time a country has come together to do this. Practically, the community of practice has taken the form of:

- A website, which contains information on reports, presentations and brief write up of the workshop and a link to the community forum.

- A LinkedIn based forum, which allows different partners to easily communicate and share lessons learnt.

- Future events, which are being planned to bring in additional stakeholders and to continue the process of jointly working together. This will hopefully include capacity building on topics such as index design, or communicating effectively with farmers.

All of this should mean that as index insurance initiatives spread throughout Bangladesh, they can learn and grow from each other so that this powerful development tool can be responsibly implemented to make a meaningful impact on poverty.

Index based insurance is making headway in Africa too. Learn more: From index insurance to commercial partnerships: what livestock farming looks like in modern Africa

Helen Greatrex is a joint Postdoctoral Research Scientist with the CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS) Research Theme on Climate Risk Management, and the Financial Instruments Sector Team at the International Research Institute for Climate and Society (IRI).