What do two decades of agricultural insurance research tell us?

The global food industry suffers a loss of billions of dollars annually due to extreme weather events and pests and diseases. Over the past decade, the crop and livestock production loss is equivalent to the annual calorie intake of 7 million adults. These losses have resulted in the need for various risk management policies, including agricultural insurance, now a 30 billion USD global industry, growing at a fast pace. This has also spurred agricultural insurance research throughout the world, which includes advances in insurance design based on data science breakthroughs, and improvement in our understanding of how different risks affect food production.

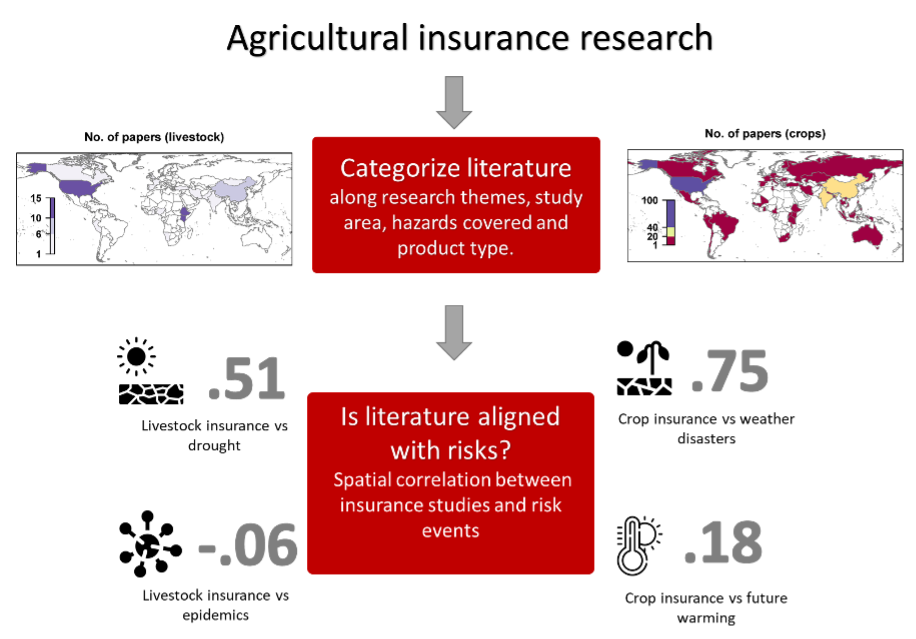

A recent systematic review on agricultural insurance summarizes these developments and categorizes the research intensity using different indicators, including agricultural product insured, research theme, geographical study area, insurance type and the hazards covered (Vyas et al., 2021). In addition, the research intensity of these indicators is mapped and compared with geographical distribution of historical and future risk and crisis events including extreme weather disasters, projected temperature increase under the SSP5 (Shared Socioeconomic Pathways) scenario and livestock epidemics.

The review highlights that current insurance research is highly concentrated in high-income countries and focuses on cereals while ignoring other regions and production systems like fruits and vegetables (South America), millets (Africa) and fisheries and aquaculture (South-east Asia). Research is also disproportionately distributed among different insurance products: index insurance is most commonly found in the review, followed by indemnity insurance, while research intensity is the lowest for revenue insurance. Finally, the results show the need to better align research with risk hotspots, as indicated by the poor spatial correlation between research intensity and risk events (especially for climate change and livestock epidemic risks).

Icon credit: This figure has been designed using visual icons from Flaticon.com

Setting a future research agenda

The systematic review summarizes the current state of insurance research and highlights important research gaps. Food systems are undergoing dynamic changes in the present world: population and economic growth are influencing food demand and threatening local biodiversity; food supply chains are becoming vertically integrated and more capital intensive and concentrated among fewer players; and conflicts, natural disasters and climate change-induced weather events are increasing in frequency and intensity.

These changes necessitate the need to risk-proof vulnerable food production systems, and on the other hand, improve insurability, especially for regions with high-risk exposure. To overcome these challenges and guarantee food security in the coming decades, future research should focus on capitalizing on data and information availability and leveraging the synergies between different risk management instruments.

Read more

Vyas, S.; Dalhaus, T.; Kropff, M.; Aggarwal, P.; Meuwissen, M.P.M. Mapping global research on agricultural insurance. Environ. Res. Lett. 2021, 16, 103003, doi:10.1088/1748-9326/ac263d.