Prototype tool can help maintain farmers’ involvement in index insurance projects

An integrated tool helps improve efficiency in data collection and makes it possible to give farmers a voice in the design of index insurance products as these projects increase in scale.

Subsistence farming of maize, groundnut, and millet is the dominating means of livelihood in Tambacounda, a region in eastern Senegal about the size of Denmark. Most smallholder farmers in the region do not have irrigation, so their crops are dependent on rainfall, known as rain-fed agriculture. But rainfall can be good on some years and bad on others—and it is just one of the many climate-related challenges that smallholder farmers face. Index insurance is one among the solutions that can help weather-dependent smallholder farmers and pastoralists like those in the Tambacounda region manage changing climate risks.

Data collection is key to designing robust insurance indexes

The ability to generate effective index insurance products hinges on the active participation of farmers in their design and refinement. Farmers need to have a say on what they are willing to pay for a product that captures the climate shocks they experience in their fields. This type of involvement is facilitated through participatory processes (e.g. farmer discussions, games, exercises) that aim to capture farmers’ practices in relation to their climate risk exposure. But the tedious paperwork processing that follows usually slows down the monitoring and validation processes on the ground.

This becomes more challenging as projects go to scale with data collection becoming increasingly costly and time-consuming. Indeed, since the conception of micro index-insurance, the logistical management of data collection in the field has been one of the main concerns facing efforts to expand these projects to cover more farmer villages and geographical regions. Compromising the strength of precise village level data capture results in larger but coarser index design, and prevents products from remaining sustainable at scale.

A prototype tool to automate the process

In November 2016, two members of the Financial Instruments Sector Team (FISTeam) of the International Research Institute for Climate and Society (IRI) returned to Senegal, where they joined their World Food Programme (WFP)’s R4 Rural Resilience Initiative (R4) Design Team colleagues again for another six-hour journey from Dakar to Tambacounda. The teams have been co-leading a series of “End of Season Assessment” field visits as part of R4 Initiative’s index insurance component, which has been established in the region since 2013. These visits serve a critical role in testing whether the index had performed well. But during this particular visit, the FISTeam was supported by the CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS) to carry out a special mission: to put in place and test a new prototype data collection tool in the Tambacounda region.

The FISTeam at the IRI serves as the technical partner in R4’s micro index insurance component, developing indexes that use rainfall measurements to determine when farmers receive payouts and providing the necessary tools for the design team to complete data collection for the project. Recognizing the challenges, FISTeam developed a data collection prototype tool that suits the type of field data they gather and complies with their existing participatory activities already implemented in the R4 Initiative.

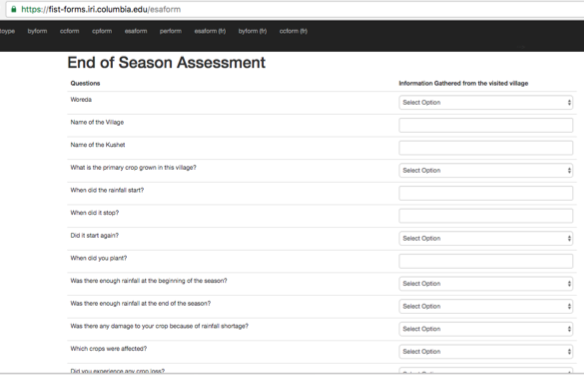

Farmers receive instructions to complete an end-of-season assessment survey using the new data collection prototype accessed through a web browser on a laptop. Prototype screenshot by FISTeam (IRI).

The tool consists of a package of automated forms—a set of questions and a data entry system—that can be accessed via web browser on a computer or mobile device to submit the information captured in the field to save directly in a database at the IRI. Using the automated forms, local implementers can facilitate the data collection and information flow between the different stakeholders much more efficiently. But will this tool be well received and valued by project partners? And will it be robust enough to help solve data collection quality issues at scale? FISTeam was eager to find their answers.

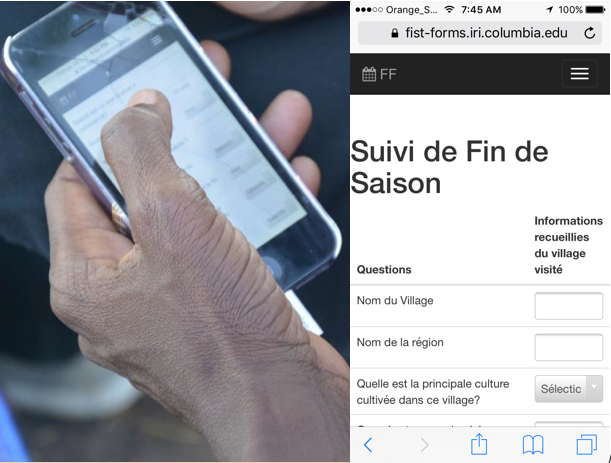

The automated forms can also be accessed through a web browser on a mobile device. The collected information allows insurance index design to be robust and representative of reality on the ground. Photo: M. Braun (IRI)

A small success with many possible applications

The two teams visited 8 villages in the Tambacounda region to conduct the participatory activities with farmers, using the new automated forms. As farmer users submitted the data, FISTeam was able to immediately access them through IRI database in a live-feed fashion. The prototype tool worked just as FISTeam had hoped for, presenting a very tangible way through which local teams—such as the R4 design team—can work with farmers at the large scales needed to make a meaningful difference without sacrificing the index insurance products’ accuracy.

“The experience of IRI and others has shown that climate risk management interventions such as index insurance can work for smallholder farmers, at a pilot scale, when they have a voice in their design,” said James Hansen, senior research scientist and CCAFS flagship leader on climate information services and climate-informed safety nets. “But as major challenges remain in scaling up this kind of intensive interaction with farming communities, the successful test run of this tool demonstrates that technological innovations can come in to assist,” Hansen remarked.

When integrated into a larger streamlined online tool, FISTeam’s tool can further be used by practitioners and project partners for index design and validation, disaster risk preparedness, and community-based adaptation strategies—particularly as projects go to scale. CCAFS support for this initiative stems from the promising potential of this tool to help launch an integrated, automated, and quantitative seasonal assessment approach to pre-existing CCAFS projects in the region and beyond. As it becomes further developed and widely implemented, this type of tools can lay the foundation for many possible applications and further innovations by development aid organizations and insurance companies.

Read more:

- Research project: Index-based insurance

- Report: Scaling up index insurance for smallholder farmers: Recent evidence and insights

- Infographic: How can index insurance help smallholder farmers? Check out this infographic

Souha Ouni is a Senior Research Staff Assistant in the Financial Instruments Sector Team at the International Research Institute for Climate and Society (IRI).

Dannie Dinh serves as the Communications Officer for CCAFS flagship on climate information services and climate-informed safety nets. She is the Special Assistant to the Director at the International Research Institute for Climate and Society (IRI).