De-risking livelihoods in climate and conflict hotspots: The need to align humanitarian and development objectives and finance

Climate and conflict are major threats to livelihoods and food security in the Global South. They reverse progress in development and were jointly responsible for driving 111 million people into acute food crises in 2019. The COVID-19 pandemic, which is accompanied by a global economic recession and the unraveling of long-standing socioeconomic disparities, is expected to accelerate this trend. The United Nations World Food Programme (WFP) projects that an additional 130 million people will be pushed to the brink of starvation by the end of this year.

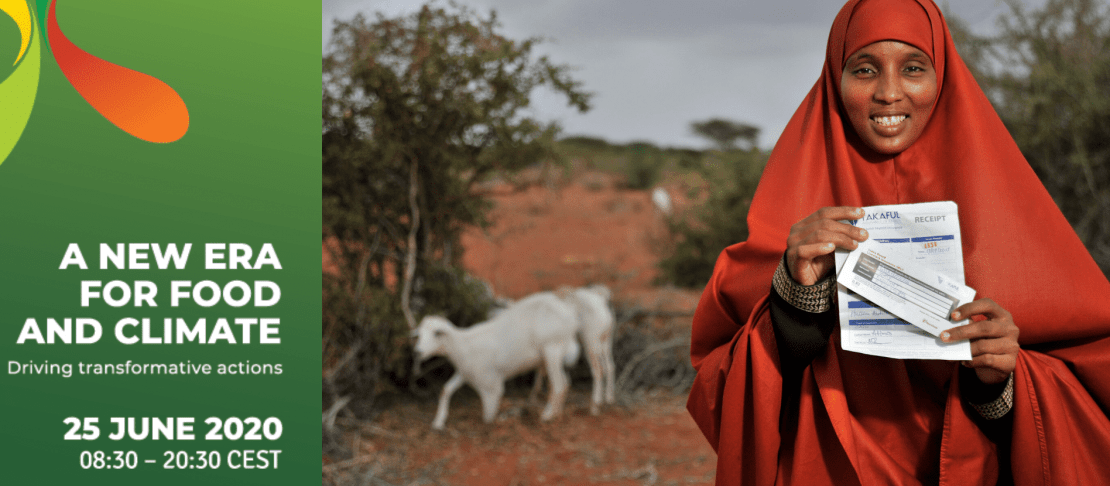

Join the discussion on “Securing resilient livelihoods and value chains through early warning and adaptive safety nets” part of the “A New Era for Food and Climate” virtual event on 25 June. |

|---|

The causes of conflict are extremely complex and influenced by a myriad of social, political, economic and environmental factors. While climate variability, as well as climate change, can never be singled out as the sole direct cause of conflict, there is a general agreement among researchers and practitioners that these factors aggravate and compound each other. Dealing with this added layer of complexity is daunting, considering the multifaceted impacts to security that the climate brings.

The role of partnerships and collaboration

The global community invests billions of dollars every year to save the lives of people in precarious situations. Due to a lack of joined-up planning and predictable, longer-term finance that bridges the nexus between short-term humanitarian aid, longer-term development and peacebuilding, relief interventions can drag out for years or decades. In such situations, it is challenging to empower people to transition out of food insecurity and into a more resilient livelihood. Understanding and leveraging the potential of partnerships and collaboration is crucial in such situations.

understanding and leveraging the potential of partnerships and collaboration is crucial

Reflecting on whether such collaboration is present and effective in the field, one may find that international development projects, humanitarian and peacekeeping work still operate in segmented spaces. At times, if uncoordinated, these mismatched objectives may not provide a clear ladder towards self-sufficiency for vulnerable and crisis-affected populations. This is especially relevant for fragile regions emerging from, or prone to, conflict. Due to the lack of coordination between different planning objectives and financing sources, in addition to the general lack of data and capacity in public institutions, such regions are at risk of being left behind in the global effort to reduce extreme poverty, food insecurity and adaptation to climate change.

This does not mean that there is no opportunity to create positive change in conflict-affected settings. Resilient livelihoods are the foundation for successfully coping with and recovering from a multitude of stresses and shocks. Recent evidence suggests that the co-benefits derived from climate action at community level can provide sufficient incentives to secure public and private support for activities that align different objectives (Castro-nunez 2020). With this in mind, establishing linkages between peacekeeping, humanitarian action, development and the emerging arena of private sector financing can help to de-risk livelihoods, and align short-term coping capacities with longer-term resilience objectives.

The role of the private sector

To deliver such cross-cutting solutions, leveraging and combining different sources of capital can unveil new pathways. Discussions around finance have often focused on the public sector and official development and humanitarian assistance. Yet, the private sector has emerged as the key opportunity for mobilizing and deploying capital for more resilient societies, including in post-conflict settings.

the private sector has enormous potential to incentivize change in sustainable livelihoods

An increasing number of private sector initiatives are active in the humanitarian, development and peace arenas. With a wide range of financial tools, the private sector has enormous potential to incentivize change in sustainable livelihoods, including through micro-insurance, risk pooling, humanitarian impact bonds, and humanitarian venture capital. These tools can be developed jointly with governments, communities, humanitarian and development partners who serve as catalysts for investments and ensure positive impact for the intended beneficiaries.

In the arena of assistance for crisis-affected populations, a first Refugee Livelihoods Development Impact Bond has been developed by KOIS. Impact Bonds are results-based contracts in which private investors provide financing for public projects that deliver social and environmental outcomes. Also, the International Finance Corporation has initiated the Conflict-Affected States in Africa Initiative (CASA) to direct resources and expertise into countries recovering from conflict and encouraging private sector participation.

Participants of the WFP's Rural Resilience Initiative in Senegal receiving an insurance payout. Photo: M. Dubreuil (WFP)

On the climate risk side of the spectrum, insurance schemes and pre-positioned contingency funds have become important mechanisms to increase communities’ ability to absorb shocks. Examples are sovereign risk pools such as the African Risk Capacity (ARC) and the Afat Vimo Risk Transfer Initiative, as well as index-based microinsurance programs such as the R4 Rural Resilience Initiative coordinated by the WFP. Forecast-based financing programs that are linked to climate services and early warning systems do not only inform vulnerable populations ahead of time that they are about to get hit by a particular hazard—these systems also trigger cash transfers and anticipatory action in time before a hazard turns into a disaster. This augments social protection systems and safety nets that are critical for reaching the most vulnerable populations.

Regions prone to conflict or emerging from episodes of violence still represent a challenge for private sector investment, as they often represent a high risk and great uncertainty about expected financial returns. To enable private sector investments, it is critical to establish a basis of self-sufficiency, support the organization of community groups, and address specific gaps that prevent favorable market conditions for vulnerable populations. Blended finance plays a key role in this process to de-risk the transition from humanitarian relief towards longer-term community and market development. With these early-stage conditions addressed, the pathway to attract private finance becomes clearer.

This blog is part of a series for the Transforming Food See details and register here. |

Read more:

- Website: Transforming Food Systems Under a Changing Climate

- Website: CGIAR Climate Security

Photo: R. Gangale (ILRI)