Bonn climate talks: Insurance offers untapped opportunity to make smallholder agriculture climate resilient

Representatives of the climate change, agriculture and insurance sectors set out an ambitious vision for accessible insurance for farmers across the developing world against weather-related losses at this year’s climate talks in Bonn.

A one-day conference showcased the successes of index-based insurance for smallholders while identifying the potential to scale up the market on a global level.

“We have seen that formally insuring farmers against extreme weather events is effective,” said Bruce Campbell, Director of the CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS), which co-hosted the event. “Insurance not only compensates smallholders to avoid catastrophic losses, it also allows them to invest and adapt, even when they don’t receive a pay-out.”

"But we need all key players to engage in order to reach more farmers. This is why events like those at the SBSTA climate talks in Bonn are so important. By bringing the insurance industry together with climate change and agricultural researchers, we can develop truly global solutions."

Watch the video outlining six priority areas discussed at the conference:

Opening the conference with a keynote presentation, Annette Detken of KfW noted that insurance is a complementary instrument for climate change adaptation, especially targeting high severity low-frequency climate risks.

Key messages on the role of #insurance for #climate change #adaptation from Annette Detken @KfW at #SB46 pic.twitter.com/Zgb82qzQqU

— Bruce Campbell (@bcampbell_CGIAR) May 14, 2017

The timely event took place after the Kenyan government paid out a record £1.7 million to 12,000 pastoralists to compensate for last year’s historic drought, demonstrating how effective this safety net can be.

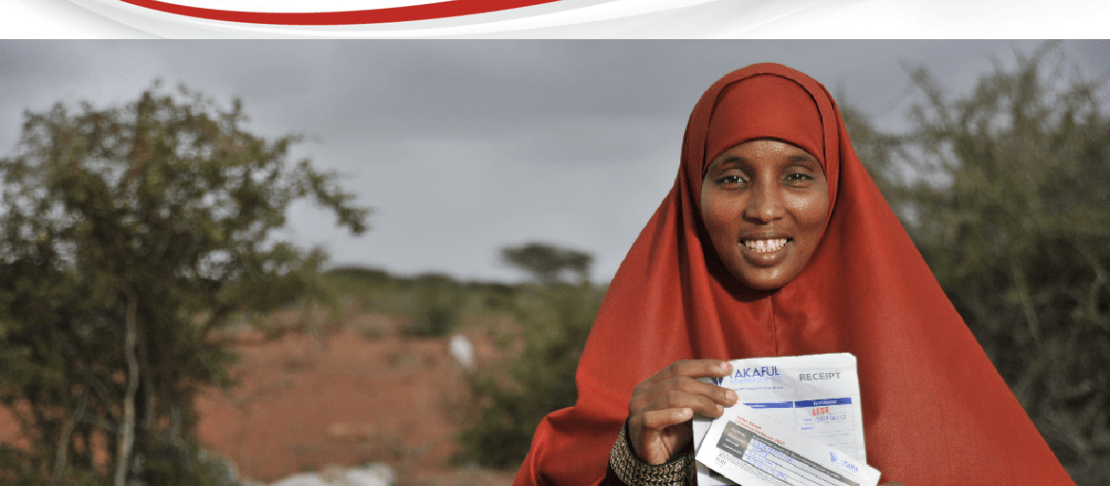

Among other successful initiatives discussed was co-host Syngenta Foundation’s Kilimo Salama project, which used innovations such as weather indexes to determine when to pay compensation, and mobile technology to reach remote smallholders in Kenya.

The project has since been launched as a company, ACRE Africa, and is now one of the sources of expertise in index-based insurance for farmers in sub-Saharan Africa. Rahab Kariuki, Managing Director of ACRE Africa, said the service provider is just one example of what can be achieved with comprehensive insurance coverage for smallholders.

Olga Speckhardt, Syngenta Foundation’s Head of Global Insurance Solutions, told the conference: “Except in absolute emergencies, smallholder farmers do not want charity. Instead, they want chances; the opportunity to learn new skills and use new tools.”

The Technical Centre for Agricultural and Rural Cooperation (CTA), one of the event’s co-hosts, also shared their experience of an ongoing project that aims to cover 100,000 livestock farmers in Kenya and Ethiopia by 2019 using weather index insurance.

Index-based insurance offers those who are most vulnerable to extreme weather events the best chance of a financial buffer. Unlike conventional insurance, which is measured by quantifiable losses, weather indexed insurance links rapid pay-outs to readily measured environmental triggers, such as rainfall or forage cover.

And it also has the flexibility to be bundled with farm inputs and with other financial services, making it more appealing to those who cannot afford traditional insurance.

But not only does it offer security when droughts, floods or high temperatures threaten to destroy crops and livestock, it also makes farmers more likely to invest in agricultural innovations and more resilient practices, thus adapting to climate change.

ACRE Africa found that insured farmers invested 19 per cent more in farm productivity, giving them 16 per cent higher earnings than their uninsured neighbours.

Panel discussion on partnership opportunities, pathways and next steps with Stan Wood (Bill & Melinda Gates Foundation), Imad-eldin A Ali Babiker (ARC), Tonya Rawe (CARE), Isaac Magina (SwissRe) and Koko Warner (UNFCCC), moderated by Jimmy Smith (ILRI). Click here to see the photos from the conference

Writing for the Financial Times, Ishmael Sunga, CEO, Southern African Confederation of Agricultural Unions (SACAU), said farmers were like any other businesspeople and deserved insurance products that were fit for purpose.

He added: "The Southern African Confederation of Agricultural Unions is actively encouraging farmers to take up weather-based insurance because we believe it is an important incentive for investment as well as a safety net for climate-related losses.”

"SACAU is currently working with the private sector to help expand an innovative weather-based insurance solution after successful pilots in Zimbabwe. We strongly believe that scaling up index-based insurance on a regional level can effectively share the burden of climate change while also breaking the cycle of high risk, low investment and low productivity.”

The event heard how scaling up index-based insurance globally would require action in three key areas: providing better linkages to farmers, harnessing big data and technology, and bundling insurance with other services to encourage adaptation.

But these discussions often came back to the need to enable greater cooperation between the international development and climate change community, the insurance sector, national governments, research and farmers’ organizations to properly tap into the potential of this market.

Agricultural research community can help develop tools to integrate the data from different sources #BigData @IFPRI #SB46 #agriinsurance

— CCAFS cgiarclimate (@cgiarclimate) May 14, 2017

While agricultural insurance has grown four-fold since 2005 and may be the largest speciality product in many countries, several challenges need to be overcome in order for insurance to work for smallholder farmers at the scale of the challenge.

By developing successful models for index-based insurance and finding solutions to the remaining challenges, researchers and development organizations hope to inspire investors to launch viable products that protect many more of the world’s two billion smallholders.

These solutions include: data availability, targeting the right farmers with the right products, distribution channels, bundling insurance with climate smart agriculture, an enabling regulatory environment, smart use of subsidies, evidence of impact, and expanding insurance to other actors in the agricultural value chain.

“Scaling up agricultural adaptation would take more than insurance. But insurance has the opportunity to transform and make society more prepared to face the challenges that we face today,” said Isaac Magina, Senior Client Manager Africa at SwissRe.

“It will take a lot of effort; we need to make joint effort between the private and public sector to make this a reality. It will take more than a day, and we have to be prepared to fund and to make it happen.”

What’s next?

The opportunity is before us to realize that vision, but requires concerted and coordinated action. Based on the discussions during the day, the conference organizers are working on a call for action targeting different stakeholders to support the scaling up of agricultural adaptation through insurance.

Read more:

- Call to action: Scaling up agricultural adaptation through insurance

- Info note: Prospects for scaling up the contribution of index insurance to smallholder adaptation to climate risk

- Background paper: Scaling up agricultural adaptation through insurance: Bringing together insurance, big data and agricultural innovation

- Op-ed in zilient.org by Olga Speckhardt (Syngenta Foundation for Sustainable Agriculture): Broad shoulders for smallholders: Why vulnerable farmers need insurance

- Op-ed in African Business Review by Rahab Kariuki (ACRE Africa): How weather indexed insurance can reduce impact of droughts on African farmers

- Op-ed in the Financial Times by Ishmael Sunga (SACAU): Farmers need insurance that is fit for purpose (Subscribe to read)

- Download the presentations from Slideshare

- View the photos on the CCAFS Flickr

The one-day conference was hosted by the CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS), the Technical Centre for Agricultural and Rural Cooperation (CTA), the Syngenta Foundation for Sustainable Agriculture (SFSA) and the KfW Development Bank (KfW).

Partners:

|  |  |

|  |  |

Donna Bowater is an Associate at Marchmont Communications