Strategising a new approach to crop insurance in India

At a recent workshop, senior government officials, researchers and industry representatives brainstormed about how insurance can serve farmers better. They came up with recommendations that can help in a new crop insurance program.

Superficial tweaks in existing agriculture insurance policies will not achieve our desired results: to protect farmers against crop losses. We need to fix the bottlenecks that have persistently plagued agriculture insurance for decades, said PK Mishra, Director General, Gujarat Disaster Management Authority. He delivered the opening talk at the workshop on ‘National Crop Insurance Program (NCIP): Challenges and Opportunities’ organised by CCAFS and International Food Policy Research Institute (IFPRI), in New Delhi on April 1, 2014.

The Chairperson of the meeting, A Bahuguna, Secretary, Ministry of Agriculture, noted that the workshop coincided with the release of the Intergovernmental Panel on Climate Change report.

The report shows the increasing vulnerability of South Asian countries to climate change. We must feel compelled to act not only to safeguard livelihood and incomes, but lives. Climate risk management is no longer an option but a necessity.”

New insurance program

In November 2013, the Government of India proposed a National Crop Insurance Program (NCIP) that will merge existing insurance schemes, such as the National Agricultural Insurance Scheme (NAIS), Pilot Weather Based Crop Insurance Scheme (WBCIS) and Pilot Modified National Agricultural Insurance Scheme (MNAIS). It aims to streamline insurance services to farmers and stabilise incomes, particularly during climatic shocks arising from extreme and unexpected weather events.

A Bhuttani, Joint Secretary, Ministry of Agriculture, said the scheme wants to get buy-in from all stakeholders and the workshop was a good opportunity to iron-out details and clarify key points.

During the discussions, a number of challenges came to the fore. Chief among them was the lack of access to credible data and the need to adopt technology.

In order to design demand-driven insurance products and undertake research for stronger scientific basis linking weather to yield, we need to be able to access historical data on weather and yield,” said S.K. Goel, Additional Chief Secretary, Government of Maharashtra.

He also called for better coordination amonggovernment agencies disbursing disaster relief funds and providing insurance. Farmers continue to view insurance as an investment and a lot more needs to be done to build awareness on insurance as a risk-mitigation strategy.

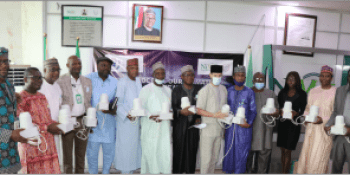

Senior government officials, researchers and industry experts identify how existing schemes can be improved. Photo: N. Sigtia (CCAFS)

Industry perspectives from Agriculture Insurance Company, HDFC, ICICI Lombard, Swiss RE, Bajaj Alliance and others, said developing a single portal to access data could be a game changer in the sector, making it possible for companies to carry out high-quality research and tailor their products for rural markets.

The use of technology such as 3D imaging, remote sensing and crop simulation modelling can increase accuracy in the measurement of weather and crop yields and in reporting and verification.

J. Plappallil, CEO, Agriculture Insurance Company of India Ltd. noted that: nobody appears happy with insurance as it stands - neither farmers, nor insurance agencies or the government.

Open, transparent and fair

While finding acceptance of all stakeholders can be challenging, it is important to ensure that processes are transparent and fair, he added. To encourage the private sector to work in agriculture insurance, regulatory mechanisms and grievance redressal systems must be strengthened. Weather stations and rain gauges must be maintained properly to reflect data accurately.

The workshop also included two parallel group discussions on the Modified National Agricultural Insurance Scheme and the Weather-based Crop Insurance scheme to identify emerging opportunities in each of these.

Participants agreed that communication lines between everyone working in the sector need to be open and transparent. Many farmers are disillusioned with the current state of insurance because it does not address their individual needs, but there needs to be a balance between bridging these individual concerns and designing a policy that can be scaled out commercially.

Key recommendations for policymakers from the workshop:

- Identify and apply appropriate technologies such as remote-sensing, simulation modelling, 3D imaging, and information and communications technologies (ICT) tools to improve accuracy and objectivity of weather related crop yield loss assessment.

- Create a single data repository where all insurance-related data on weather and crop yield data is easily and equally accessible to all stakeholders.

- Develop an atlas of thresholds for critical weather elements that trigger crop yield losses during different crop growth periods for different agro-climatic regions which could be used by the government and insurance industry as benchmarks.

- Quantify the optimal number of crop-cutting experiments that must be done for NCIP using appropriate scientific techniques such as Geographical Information Ssystems and remote sensing.

- Establish historical time series of crop yields need to be at village/panchayat/block level to support NCIP.

- Develop innovative schemes by bundling insurance with other financial services such as loans, sale of inputs, and other risk management strategies to reduce cost of transaction and for long-term viability.

- Strengthen and standardize regulatory and monitoring systems and grievance redressal mechanisms.

- Further research and coordination on macro-insurance policies at state or national level should be pursued. Convergence of disaster relief management and agricultural insurance can yield unique products.

- Raise the capacity of farmers to understand details on crop insurance.

- Promote innovation and learn lessons from innovative pilot projects on agriculture insurance by local NGOs and companies.

Further reading:

Weather index-based insurance: a tool for managing climate risk

How to accommodate farmers wary of rainfall insurance

Farmers reap the benefits from climate insurance scheme

Dharini Parthasarathy is communications specialist at CCAFS South Asia