How can index insurance protect farmers against climate-based risks?

World Food Day 2015 highlights the role that social protections take to alleviate poverty in agriculture-based rural communities.

Many agriculture-based rural communities are vulnerable to the impact of climate change. What can be done to help mitigate these impacts?

What is index insurance?

Index insurance provides coverage based on an index correlated with farmers’ losses and factors such as rainfall during a specific timeframe (weather-based indices), or average yield losses over a larger region (area yield indices). Payouts are triggered when this index falls above or below a pre-specified threshold.

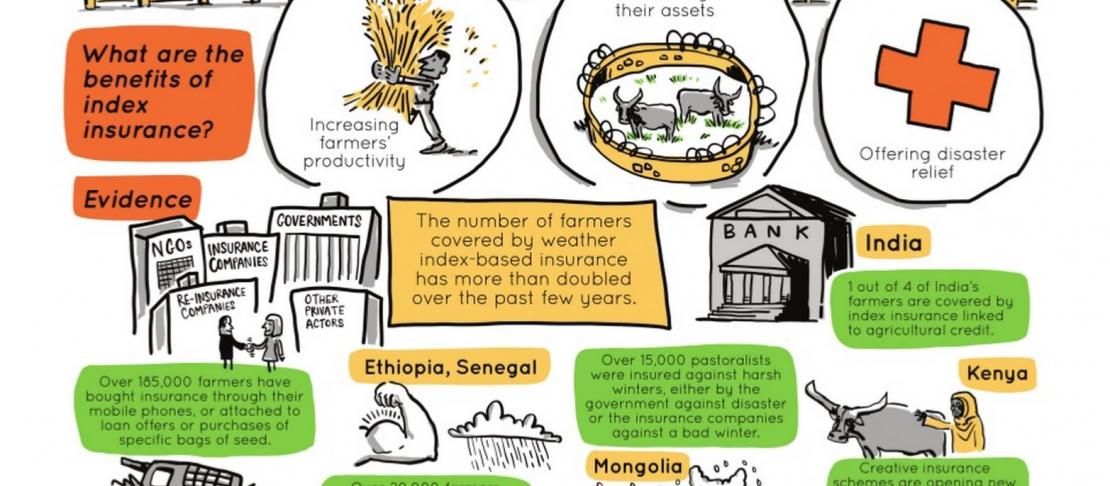

Recent case studies from different countries point to the potential for index insurance to protect farmers’ and pastoralists’ assets and livelihoods under climate variability risks at a significant scale. In India alone, national index insurance programs have reached over 30 million farmers. The case studies provide insight into the types of index insurance schemes that are building farmers’ resilience against climate risks, reducing poverty with payouts in bad years, and offering opportunities for increasing productivity in non-payout years.

Linking to agricultural credit: India

India administers state-sponsored index insurance programs, which protect not only the wealthiest or best-educated farmers, but also some of the most marginal. The National Agriculture Insurance Scheme (NAIS) triggers payouts if regional yield measures fall below a pre-specified threshold. The modified NAIS (mNAIS) came about, in part, to change government financial liability to subsidize premiums up-front. Under the Weather-Based Crop Insurance Scheme (WBCIS), about 40 crops are insured under the category of climatic risks such as dry spells, low/high temperature, excess rainfall, high wind, and high humidity. The scalability of these schemes is largely attributable to high premium subsidies and insurance as pre-requisites for agricultural credit.

Innovations in index insurance: Kenya, Rwanda, and Tanzania

The Agriculture and Climate Risk Enterprise (ACRE) program has recently scaled up to reach close to 200,000 farmers across Kenya, Rwanda, and Tanzania. It has done so by developing strong partnerships with lending providers and input suppliers. It has also adopted innovative approaches for premium payments and payouts including M-PESA mobile banking services (over 19.3 million users in 2014). ACRE has reached thousands of remote farmers using this technology.

Targeting the uninsurable: Ethiopia and Senegal

The R4 Rural Resilience Initiative has scaled unsubsidized index insurance to over 20,000 smallholder farmers in Ethiopia and Senegal. These farmers were previously considered uninsurable because of poverty, lack of education, their remote location, and lack of data. The initiative succeeded using insurance as a key part of a comprehensive risk management portfolio. It has reached a considerable scale, reaching highly vulnerable smallholder populations by adopting participatory processes and strong institutional partnerships, as well as with scientific support.

Transforming institutions: Mongolia

With strong public and private sector support, Mongolia’s Index-Based Livestock Insurance Project (IBLIP) insures more than 15,000 nomadic herders and links commercial insurance with a government disaster safety net. IBLIP provides financial protection for, and works with, herders to strengthen their resilience to extreme weather impacts, such as harsh winters leading to high number of livestock deaths.

As it transforms from a donor-funded project to private company, IBLIP will look at new ways to work with local banks and microfinance institutions, and address the challenges of an area undergoing cultural and institutional transformation.

Insuring remote pastoralists: Kenya and Ethiopia

The Index-Based Livestock Insurance (IBLI) project in Kenya and Ethiopia provides insurance to nomadic pastoralists to keep them out of poverty by protecting them against drought-related livestock losses. Payouts provide immediate benefits as pastoralists are likely to buy more livestock, less likely to sell existing stock, and remain food secure. Satellite information calibrated with livestock mortality data informs the scheme of climate-based risks while plays, radio, posters, and educational games inform pastoralists in remote areas about their insurance options.

What have we learned?

Index insurance schemes can provide strong protection benefits for smallholder pastoralists when they:

find ways to strengthen farmer livelihoods/incomes;

link insurance to interventions such as agricultural credit and climate risk management;

bring farmers into product design process;

strengthen local capacity and partnerships; and

use innovative approaches and technologies.

Learn more

Report: Scaling up index insurance for smallholder farmers: Recent evidence and insights

Infographic: How can index insurance help smallholder farmers? Check out this infographic

Research project: Index-based insurance

Catherine Hill is the Gender and Social Inclusion Programme Manager for CCAFS.